The electronics industry’s pivotal role is reflected in the following industry segments – the high reliability electronics for aerospace and the healthcare industry; the medium reliability electronics for industrial electronics, automotive and security systems; and the lower reliability applications for household appliances. In the case of all these categories, manufacturers play diverse roles ranging from offering design services to taking on product retrieval post ‘end of life’. Here’s an insight into all that goes into the electronics manufacturing process.

By Ankan Mitra

In the overall electronics system design and manufacturing (ESDM) value chain, electronics manufacturing becomes or can potentially become a bottleneck due to its very nature. It is hence even more important to understand the different aspects involved in electronics manufacturing.

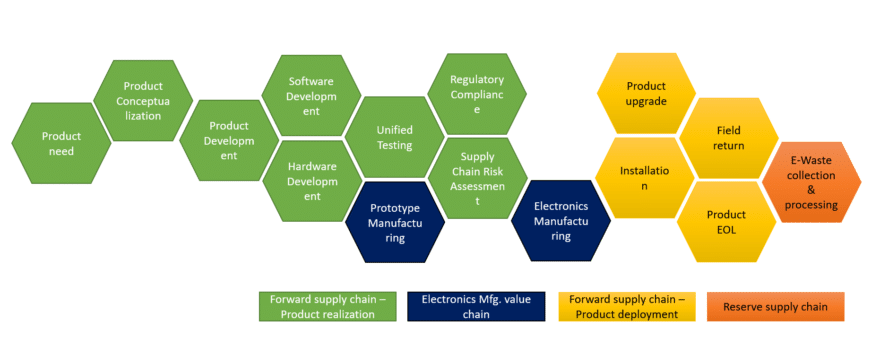

Figure 1 helps us understand the scope and pivotal position of electronics manufacturing within the ESDM industry.

Even though the value chain depiction in this figure is highly iterative in nature, concurrencies are followed in order to reduce time to market as much as possible. As illustrated, electronics manufacturing typically happens during prototype manufacturing and during ramped-up manufacturing. However, beyond physical manufacturing, electronics manufacturing has successfully backward integrated into the phases of designing the product as well as forward integrated into product distribution, shipping and ‘end of life’ (EOL) management.

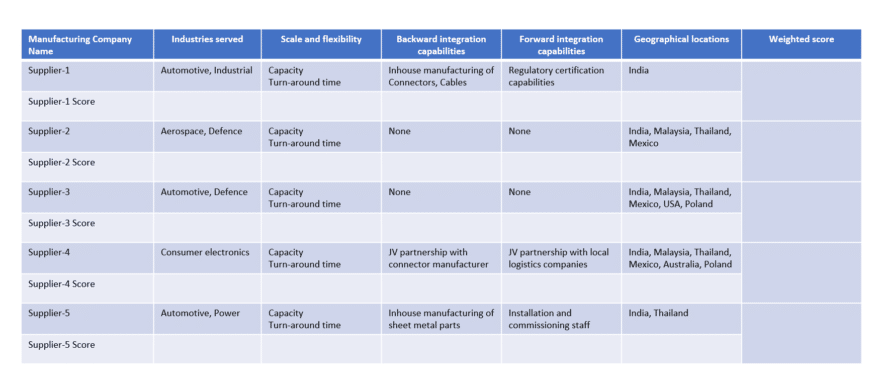

Electronics manufacturers ensure the availability of basic infrastructure that is common for all types of electronics manufacturing. These manufacturing companies are segmented in various ways, as shown in Figure 2, and as discussed below.

The diverse requirements of different segments of the electronics industry

In addition to the basic manufacturing infrastructure and knowhow, additional capabilities are required to serve certain industries. Electronics for space applications requires manufacturing in a dust-free atmosphere. Hence, cleanroom facilities that have a typical dust-count of <10,000 ppm are required and these need to be monitored using dust-count meters. On the other hand, industrial electronics, particularly for power applications, involves the assembly and soldering of heat-sinks. This requires the deposition of special thermally conductive material followed by heat application, which requires additional equipment. Consumer electronics is driven by the demand to reduce the device footprint; so this requires the use of smaller components which have less inherent protection mechanisms from electrostatic discharge. In such cases, the factory infrastructure needs additional ESD process capabilities. Further, a majority of electronic systems at present use various types of bottom termination components (BTCs), which require special inspection systems like X-rays, with multiple dimensions. Such facilities require audit and recertification or, in some cases, regulatory licensing and re-licensing to ensure their service capabilities are appropriate for the various industries they target to serve.

Production plants that offer scale and those that offer flexibility

An example of the high volume, low mix manufacturing model is electronic meters, which are installed in every house, at factories and other types of premises. The design of the meters also does not change very often. In the case of such products that have a captive market and need to be manufactured in millions, backed by a stable design, the manufacturing facilities should be designed to handle high volume, low mix manufacturing.

On the other hand, during early design phases, multiple revisions are done and each revision of the design needs to be verified before finalising one. Hence, small quantities of each design need to be manufactured. Such scenarios require manufacturing flexibilities, which are achieved in the high mix and low volume manufacturing model.

Differentiation based on background integration

Mobile phones are manufactured in high volumes. For such products, in addition to the core electronics of logic, memory and power supply circuits, various semi-passive or passive components are used such as displays and certain types of switches, connectors, heat-sinks and other mechanical parts. In order to avoid supply chain risks, mobile phone companies try to identify manufacturers who in addition to assembly capabilities can also make some of the semi-passive or passive components within the organisation. In such cases, these mobile phone companies try to identify backward integration capabilities.

Segmentation based on forward integration

Some companies have core design capabilities and want to stay focused on such key strengths. However, they want to enter various markets, based on the relevance of their product. In such cases, these companies look for partners who can help provide the various services required to enter such identified markets like the necessary regulatory support, by liaising with specific agencies. Further, such companies also look to connect with logistics and distribution channels. These companies try to identify manufacturers who can provide such additional services—liaison capabilities with local regulatory authorities, providing in-country logistics support, etc.

Geographical location

Some companies want to mitigate the risks involved in concentrating all manufacturing at a single location. Also, for various product types, governments mandate local sourcing or a certain percentage of value addition within the country that the product will be marketed or deployed in, resulting in demand for manufacturing partners. In such cases, companies try to identify manufacturing partners who have the capability to handle their design and manufacturing across various locations.

A combination of the above options is typically considered prior to selecting manufacturing companies. A weighted score decision matrix is used by companies to identify manufacturing partners based on the requirements of their product, the markets they want the product to be sold in, and other such important decision metrics.

Now let us briefly review the core functions of an electronics manufacturer and the peripheral services such companies provide, as laid out in Figure 4. Selected services and manufacturing processes within core manufacturing services are reviewed separately.

PCB design services

A printed circuit board (PCB) is the interconnecting structure that supports tracks carrying power and signals across various components of an electronics system. Some of the designs are very complex in nature; hence, design talent is retained within the organisation. This is particularly true of the telecommunications, aerospace and healthcare industries. On the other hand, when the designs are generic in nature, they can be outsourced to generalist PCB design professionals rather than being designed by highly experienced and expensive resources. Electronics manufacturers provide such design services as a part of their extended portfolio of offerings. Considering such design is performed within the manufacturing organisation, it results in higher confidentiality. Further, the constraints of the manufacturer are already factored into the design process, resulting in a manufacturable design.

Component selection

Electronic systems have defined dimensions, and the devices they are placed in are expected to work in certain specified conditions of humidity, temperature, etc. The components selected for a particular system need to exceed such conditions in terms of ambient capabilities or be even smaller than the specified physical dimensions. Further, components with similar functions are manufactured by various companies. Electronics manufacturers maintain a huge database of such components including non-technical details like minimum order quantity, lead times, pricing, etc. This data is extended as a service to companies along with active professional support from component engineers.

Regulatory compliance

Depending on the type of electronic system and the geography it is expected to operate in, the device needs to get certified by appointed agencies to comply with various requirements/standards like the Restriction of Hazardous Substances (RoHS), Electromagnetic Interference/Electromagnetic Compliance (EMI/EMC), Federal Communication Commission (FCC) rules, etc. Experienced electronics manufacturers know the requirement to attain such compliance. Since they have worked in close coordination with the compliance agencies, they are able to ensure successful regulatory compliance and thereby achieve the necessary certification.

Component obsolescence and product data management services

Electronic products typically have a short life cycle, which can be as short as 18 months. Components used in such products have an even shorter life cycle; hence, obsolescence tracking becomes very important. Existing components in the design need to be tracked, while alternate components with similar functionalities need to be identified and tested for compatibility with the existing design. Sometimes, this may require design changes in circuitry, resulting in redesigning of the PCB. The qualification results post testing need to be approved, which in turn may lead to a revision of the Bill of Materials (BoM). Such versions of the BoM for each product type need to be closely monitored and various departments within the company (like procurement, shipping, manufacturing engineering, field installation, etc) need to be notified through Engineering Change Orders (ECOs). All such services are offered by electronics manufacturers as part of the product data management (PDM) service.

DFx services

Before agreeing to manufacture a product, companies verify whether the design provided can be manufactured or not, or whether any changes need to be made in it to increase the manufacturing yield. Customers can review such suggestions and implement them in the design. This review cycle to improve manufacturing yield and resolve any manufacturing issues resulting from design is called the Design for Manufacturability (DFM) review. The products that are manufactured need to be tested. Hence, the Design for Testability (DFT) review verifies whether 100 per cent of the components that are assembled can be tested or not. The alternate verification mechanism in case a few components cannot be tested electronically is also defined. Like DFM and DFT, there are various other reviews conducted by electronics manufacturers based on their experience. These include DFSS – Design for Six Sigma, DFU – Design for Usability, DFP – Design for Packaging, and DFR – Design for Reliability. All these are packaged as DFx services.

Sourcing

New components to replace those becoming obsolete are identified by the sourcing department in coordination with component engineers. The sourcing team also continuously identifies alternate sources or develops new ones for components that are already under potential supply chain risks. For example, during the tsunami in Japan (in 2011), certain high speed PCB laminate materials which were qualified and single sourced from factories in Japan, were not available for prolonged periods of time. The sourcing departments of various companies stepped up efforts to identify equivalent alternate materials from Germany and USA, and subsequently got them qualified for use in manufacturing. Sourcing departments also negotiate the initial price agreement and put in efforts for long term agreements, depending on the type of component.

Procurement

Based on operational requirements in the manufacturing process, the procurement department ensures optimum levels of inventory, through the use of enterprise resource planning (ERP) systems available within the organisation. The procurement department works closely with the sourcing team to leverage the pricing agreed upon with the suppliers along with other commercial terms and thereby manages the overall ‘requisition to pay’ process. Procurement teams also play an important role in the long term sustainability of relationships with suppliers.

Warehousing – Manufacturing – Shipping

This is the core functionality of manufacturers, whereby the optimum inventory of the components and other materials required for manufacturing is maintained. As per the production requirements prepared by the planning team, products are manufactured, stored and then shipped to the required destination as specified by the customer. The manufacturer uses various innovative techniques during this process like plant automation, remote inventory monitoring, etc, to bring in efficiency to the various processes involved at this stage.

Local programming

Some electronic systems need to function in different ways depending on the geography the product will be sold in. For example, there can be requirements like the availability of specific languages. On the other hand, certain product functionalities need to be restricted in some countries. Such changes on the same hardware device are implemented by changing the software in the device. Manufacturers provide such services through their local presence or through regional hubs.

Product upgrades

Some electronic products are designed with the intention of field serviceability. Such products have Field Replaceable Units (FRUs), which on being changed upgrade the functionality of the product. Manufacturers maintain an inventory of such FRUs, and have trained personnel who make the necessary changes in the field, ensuring the product continues to function without disruption.

Reverse logistics

Due to the functionality of certain electronic systems or the type of raw materials used in a system, regulations may mandate that the systems are retrieved from the field once the product reaches its End of Life (EoL). This requires a complex track and trace mechanism during the initial shipping of the product. Electronics manufacturers implement such tracking systems during manufacturing as well as provide logistics support in the retrieval of the product.

E-waste

Due to environmental degradation, there are various regulations being implemented globally for the disposal of electronic waste in a safe manner. One such regulation is WEEE – Waste Electrical and Electronic Equipment. Electronics manufacturers are forward integrated with such e-waste processing firms, thereby ensuring environmental safety. In this retrieval process, precious raw materials like gold, copper, aluminium as well as various resins and plastics are obtained and reprocessed for making new products.

The electronics manufacturer provides these services in various forms for the customers to choose. A few other peripheral services not covered here include failure analysis, R&D services, implementing future electronics like 3D printing, wearable electronics, handling and prevention of counterfeit electronic components, etc.